As a business owner, it’s your responsibility to do everything within your means to limit risk and to keep the business running smoothly. But how do you limit the possibility of a lawsuit to ensure business continuity?

No one can control every eventuality, but there are five actions you can take today to protect your company.

- Structure Your Business

- Get Liability Insurance

- Create Employee Contracts

- Organize Subcontractor Agreements

- Create Privacy Policy & Terms of Use

Structure Your Business

When you go to register your business with the state, you will need to choose a business structure and the choice you make will decide how much you pay in taxes as well as your personal liability. To structure your business, your options are:

- Sole Proprietorship

- Partnership

- Limited Liability Company (LLC)

- Corporation

- S Corporation

While your choice will be dependent on many factors, many businesses become an LLC as this separates your personal assets, such as your home, vehicles, and savings from your business assets. You will also need to apply for a tax ID number and ensure you have the appropriate permits and licenses in accordance with the state in which you operate.

Get Insurance

Every business should have commercial liability insurance. Liability insurance will protect your business financially if your company is sued by a third party, such as a customer or partner. It is important to note that general liability insurance does not cover things that happen to you, your employees, or commercial premises.

In addition to commercial liability insurance, you may also want to consider including

- Professional liability insurance:

- Covers costs incurred due to work errors such as negligence, copyright infringement, or personal injury.

- Commercial auto insurance:

- Covers the damage to commercial vehicles and property

- Worker’s compensation insurance

- provides employees with medical compensation, wage, and other financial benefits if they are injured or become ill on the job.

Every company should buy liability insurance, just in case, say, a client trips and falls on your property. Additionally advantageous is thinking about getting mistakes and omissions insurance (E&O). This will make sure that your company is safeguarded in the event that a client or customer accuses the owner of making a mistake or failing to uphold a contract.

In addition to buying liability insurance, you can also include liability insurance in your contracts. You should specify in the contract that you are not responsible for incomplete work caused by natural disasters, a dispute with a supplier, or some other uncontrollable event that could make it difficult for you to execute the terms of the agreement and expose you to legal action.

Create Contracts for Employees

Whether you will be taking on employees soon, or in the future, you need to ensure that you are compliant with the law, your responsibilities as an employer, and employee rights. As this is a complicated subject, make sure you seek legal advice to make sure you have addressed all relevant issues, such as discrimination, working hours, health and safety, and codes of conduct.

If your staff members will be working on the property, you must also make sure that you are offering a secure workplace with all the required risk assessments, tools, and safety measures.

Avoid Liability with Subcontractors

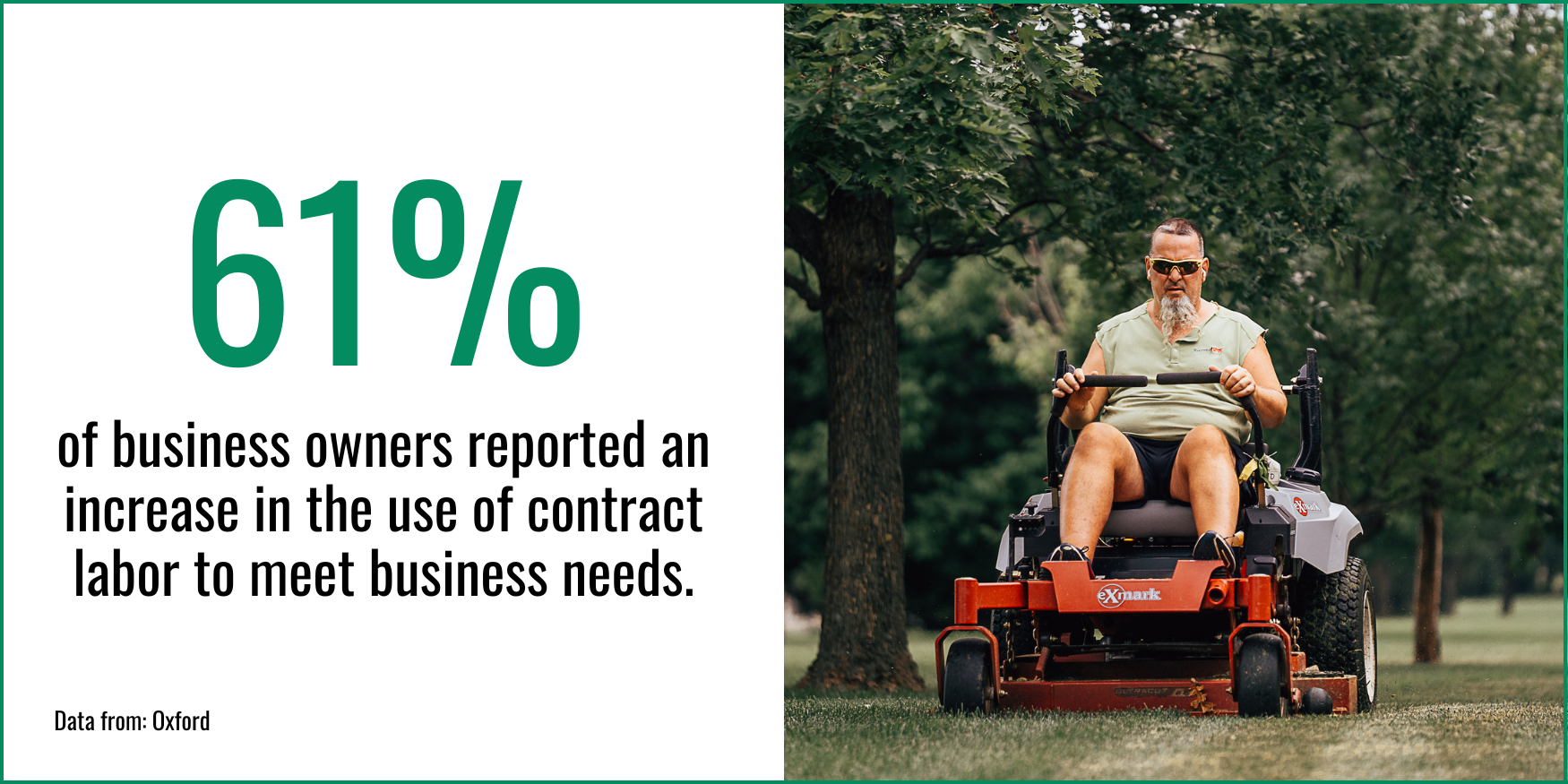

There is currently a rising trend of contract labor. According to an Oxford Economics survey, 61% of business owners reported an increase in the use of contract labor to meet business needs (Oxford). In addition, a 2022 forecast predicted 47% of employers are looking to hire part-time or contract workers (CareerBuilders).

If you are planning to outsource different parts of your business, you should also make sure that you are not held liable for their actions. As an example, if they are not providing a fair workplace for their employees in terms of health, safety, pay, or ethical working practices, their business’ reputation could be tarnished simply due to association.

Create a Privacy Policy and Terms of Use

Use your website to safeguard you, your company, and its material. A privacy policy, terms and conditions, and website disclaimer should be included on every website. If you gather email addresses or have a “contact me” form on your website, a privacy policy is most certainly legally needed.

In a nutshell, a privacy policy explains to people how, when, and why information is collected. A website disclaimer informs readers in no uncertain terms who you are, what you do, and how competent you are. Your terms and conditions page/contract is the place to set the rules and regulations of using your site.

Leave a Reply